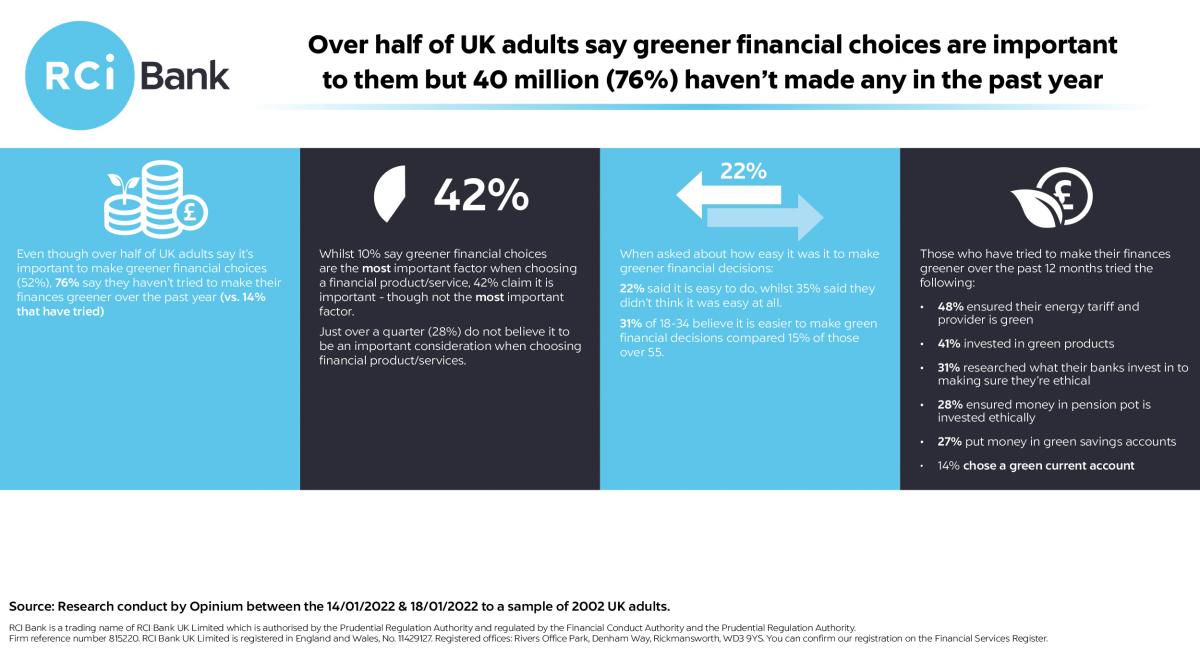

Did you know that over half (52%) 1 of the nation say it’s important for them to be able to make greener financial choices? However, despite this, over a third of us (35%) think it’s currently very tricky to do so and may need some further help accessing the world of green finance.

This month, the ‘UK Sustainable Investment and Finance Association’ – or UKSIF are set to publish a report delving into the net-zero financial sector. The report will identify how companies are adapting their products and services to become better for the planet. In celebration, we’ve whipped up a simple guide to breakdown the types of environmentally friendly options available.

What is a green pension?

A green pension is essentially a retirement fund that earns interest via investment in strictly planet-positive, low-carbon companies and projects. Data shows that only 22% 2 of pension holders know the types of companies their money is being invested in. Switching to a green pension can be hugely impactful, as experts say the transition of an average pension pot (approx. £30,000) could reduce up to 19 tonnes of carbon emissions a year.

What is a green energy tariff?

The Energy Saving Trust defines a green energy tariff as “some or all of the electricity you buy is 'matched' by purchases of renewable energy that your energy supplier makes on your behalf” 3. These sources could include wind farms and solar panel or hydroelectric power stations. We understand that in the height of an energy crisis, now may not be the best time to switch, especially if you’re on a fixed rate tariff. However, if you’re curious about whether your current energy provider is partly renewable, you can always enquire about the general percentage of sustainable energy that’s included in your tariff.

What is a green mortgage?

To qualify for a green mortgage, a house buyer needs to demonstrate that the new-build property they want meets high environmental standards and can achieve a good sustainability rating once reviewed. If successful, then a bank or mortgage lender will potentially offer lower interest rates or a higher loan amount as an incentive. If the buyer plans to renovate an older building, they must agree to invest in a sustainable upgrade for their home.

What are green savings and investments?

Green or ethical savings are savings accounts or products which fund eco-friendly and socially positive projects and causes. These may include tree-planting initiatives, organic farming, carbon reduction, renewable energy and social housing or local charities. For example, deposits from the RCI Bank E-Volve Savings 14 Day Notice account go towards the expansion of green transport and mobility as the nation makes the switch to electric vehicles.

1 Research was carried out online by Opinium Research amongst 2,002 UK adults between 14th-18th January 2022. The results are weighted to nationally representative criteria.

2 The Pensions and Lifetime Savings Association via Which?

If you’d like to learn more about our green savings product and the ways that RCI Bank are committed to improving climate change, please click here.

Hello,

We’ve scheduled maintenance on RCI Bank’s website on Thursday 24th October from 5.30pm to 7.30pm. During this maintenance window, there is no expected downtime however if you experience interruption during your session then please refresh your internet browser to restore your session